Broad Based Fees

Broad-based fees for institutions within the State University of New York (SUNY) are generally charged to all enrolled students to finance discrete activities that benefit the student body—excluding those activities that are part of the core instructional program.

Buffalo State's broad-based fees include the athletics, college, health, technology and transportation fees.

Broad-based fees are intended to work in concert with SUNY's rational tuition plan, providing students and their families with information that will help them to plan for the costs of college. SUNY's expectations for campuses include:

- Student consultation through open forums

- Annual increases limited to covering mandatory costs, expansion of existing services, provision of new services or upgrades to equipment.

- A rolling five-year plan for broad-based fees

SUNY's Policy on Fees, Rentals and Other Charges provides system-level information regarding broad-based fees. Buffalo State's Broad-Based Fees Policy describes the process for establishing fees at this institution.

Additional information on Buffalo State’s Broad-Based Fees can be found at https://financeandmanagement.buffalostate.edu/broad-based-fees

Course Based Fees

Fees for credit-bearing academic courses require approval from SUNY, per SUNY Fee Policy. Requests must include documentation and justification of the need for the charges and a budget.

All new fees and increases to existing fees should be submitted during the annual Strategic Resource Planning Process (SRPP). If you have a request outside of the SRPP process please contact us at financialmanagement@buffalostate.edu.

Below are the term due dates for Course Based Fee implementation due to SUNY and due to Financial Management:

| Semester | SUNY Due Date | Financial Management Due Date |

| Fall | May 1st | March 1st |

| Winter | September 1st | July 1st |

| Spring | October 1st | August 1st |

| Summer | April 1st | February 1st |

A list of SUNY approved course fees can be found at https://studentaccounts.buffalostate.edu/course-fees

Agency accounts are accounts that are held by a Buffalo State related organization in a custodial or fiscal agent capacity. Agency accounts are used to receive, hold, and disburse non-state funds for approved activities as a fiscal agent for students, faculty or staff members, and appropriately recognized organizations. Additionally, the Buffalo State College Foundation is a fiscal agent authorized by SUNY to administer agency accounts. All agency accounts are subject to direct cost assessments. To ensure compliance with SUNY expectations, the Foundation follows the SUNY Agency Account Guidelines, and the Foundation contract with the University, when carrying out its role as a fiscal agent of campus-agency.

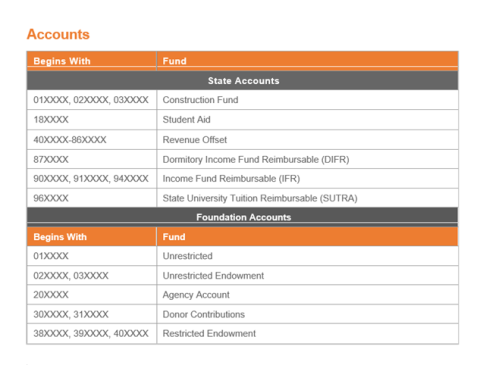

The following terms may be found on Budget Office forms.

Account Title - The title of the account to which the position resource is or will be budgeted. This is often the same as the Department, but can be different.

Account Number - The eight number is associated with the Account Title. This is where the position resource is or will be budgeted. Account number format is XXXXXX-YY where XXXXXX is the account number and YY is the sub-account number.

Annual Salary Rate - All Civil Service and SUNY positions have defined salary schedules with minimum and maximum salaries for the salary level. An annual salary rate must equal or exceed the minimum salary rate for the budgeted position title and salary grade.

Anticipated Hire Date - The requested effective date for a new hire.

Budgetary Category - Buffalo State allocation is divided into major classifications or objects of expenditure. These categories are Personal Service Regular (PSR), Temporary Service (TS), and Other Than Personal Service (OTPS).

Budgetary Object Code - The four digit that code that is associated with the budgetary category.

Budget Title - All positions have official budget titles and associated salary level. If unsure of current status, please contact the Budget Office (ext. 4312). If a new position is being established, please contact the Office of Human Resource Management (ext. 4821) to ensure appropriate budget title and salary level is selected based on the job description for the position.

Department - The primary program area with which the appointed employee will be affiliated.

FTE - Full-Time-Equivalent describes the position's percentage of time. Full-time positions are budgeted at 1.0 FTE. Half-time positions are budgeted at .5 FTE.

Line Number - This is a unique five-digit identifier for the position. Only one person may be paid from a Line Number on any given state payroll.

Local Title - Occasionally the position's Budget Title may be deemed insufficient to describe a specific scope of position responsibilities. In such instances a Local title may also be specified.

Obligation - A position may be filled with an incumbent whose annual service obligation is for twelve months (Calendar Year), for the academic year (Academic Year), or for a period of less than twelve months (College Year). Different salary schedules may apply and position resources may be affected.

Other Than Personal Service (OTPS) - This budgetary category refers to active resources that are for non-salary expenditures at Buffalo State. This would include supplies, travel contractual services, library acquisitions, and equipment. Recharges are included in the OTPS category.

Permanent Adjustment - A budget adjustment processed on a permanent basis and incorporated into the current and following fiscal year departmental budget allocation.

Personal Service Regular (PSR of PS) - This budgetary category refers to resources that are allocated for positions with an Annual Salary Rate (ASR).

Position - Budgeted only in the Personal Service category, a position is established with permanent resources, paid using an Annual Salary rate basis only, and is of a continuing nature.

Position Release - Approval to hire on a Personal Service Position.

Reallocation of Funds - Also called a "budget transfer", reallocations move budgeted funds between categories of allocation e.g., from OTPS to Temporary Service (TS), within a fund.

Recharges - Centralized services funded by charge-back to departmental accounts. This would include storehouse supplies, telephone, postage, and duplicating. These categories are included in (OTPS).

Salary Rank/Grade - The Salary Rank or Grade is determined by choice of Budget Title and scope of job duties.

Temporary Adjustment - A budget adjustment is processed on a temporary basis and the adjustment will be incorporated only within the current fiscal year departmental budget allocation.

Temporary Service (TS) - This budgetary category refers to resources that are allocated for appointments with a short-term duration.

Financial Business Intelligence (BI) is an inquiry-based application used at Buffalo State to monitor financial activity in state-appropriated accounts. Please check the BI website concerning secure access to accounts and training information or email your questions to: Financialmanagement@buffalostate.edu

Self-Service Training: Financial Business Intelligence (BI)

Below is information, including training videos, on accessing financial account information in BI.

BI Financial Training Document (PDF)

All videos can be viewed online on the IFR & Recharge Accounting YouTube channel.

Log in to SUNY’s Business Intelligence (BI) Financial Dashboards at www.suny.edu

The Account Summary Dashboard has multiple pages available to users. They include:

- Account Summary - Areas covered in the Account Summary tab:

Overview:

Financial Data:

IFR Cash:

- Multiple Accounts Summary

- Payroll Search

- Open PO’s

- Actual Alloc/Exp/Enc (Advanced options – video forthcoming)

- Pending Alloc/Exp/End (Advanced options – video forthcoming)

- All Alloc/Exp/Enc (Advanced options – video forthcoming)

Users will also have access to the Reference Dashboard. Items covered in the Reference Dashboard include:

Tips & Tricks

Support Tables

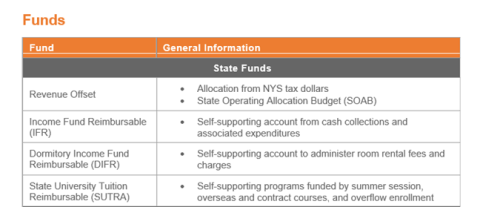

Funds

Reporting Structure

Training Modules & Documents

Other training information regarding the general use of BI:

Buffalo State's Voluntary Separation Program (VSP) results are available to the campus. You will need to login with your Buffalo State userid and password to view this information:

Buffalo State's Financial Sustainability Plan update as of December 2024 is available to the campus. You will need to login with your Buffalo State userid and password to view this information:

2024-2025 Financial Sustainability Plan-December 2024

2024-2025 Financial Sustainability Plan-September 2024

Buffalo State’s state appropriated core operating expenditures by division are available for internal review (campus login required). Data provides a high-level account of year over year expenditures in the Revenue Offset fund.

YOY Expense RO by Division 2016-2017 to 2020-2021

YOY Expense RO by Division 2017-2018 to 2021-2022

YOY Disbursement by Division 2018-2019 to 2022-2023

Financial reports are available to campus faculty and staff by account for both State appropriated funds and Foundation funds.

Please complete the Security Access & Authorization Form and submit it online.

We will follow up to obtain supervisor approval and confirm once access is granted.